A 529 plan can feel like a jetpack for college costs: you invest, the money grows tax-free, and qualified withdrawals stay tax-free too. Yet Bright Start (Illinois) and the Michigan Education Savings Program aren’t carbon copies. Illinois offers one of the richest state tax deductions, while Michigan counters with ultra-low fees. Picking the right home for your dollars keeps more tuition money in your pocket. Stick with us—we’ll compare the tax breaks, expenses, and investment menus so you can decide which plan lifts your family higher.

Snapshot: meet the two heavyweights

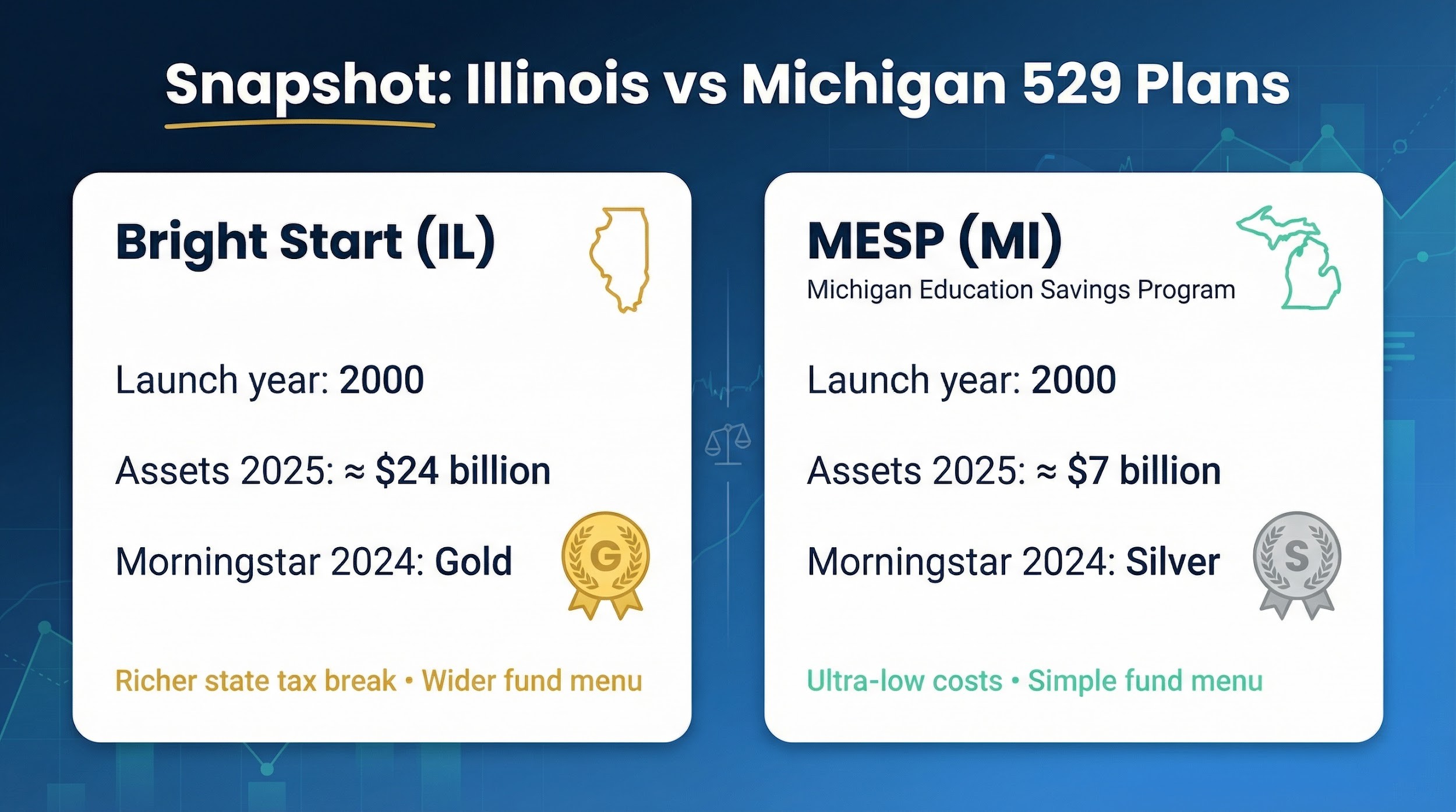

Illinois launched Bright Start in 2000 and hasn’t slowed. The direct-sold plan now manages about $24 billion and has earned Morningstar’s Gold medal seven years running, evidence that its 2017 overhaul worked.

Bright Start charges no application fee or minimum contribution, so families can open a 529 account online in minutes. The Illinois Treasurer’s 25th-anniversary report shows that more than 22,000 households did exactly that in 2025, lifting total participation above 327,000.

Michigan’s MESP opened the same year but chose simplicity and low fees. That focus has pushed assets past $7 billion and secured a Silver rating in Morningstar’s 2024 review for “diligent stewardship” and “low fees.”

A quick side-by-side shows the gap:

| Plan | Launch year | Assets (2025) | Morningstar 2024 |

| Bright Start (IL) | 2000 | ≈ $24 billion | Gold |

| MESP (MI) | 2000 | ≈ $7 billion | Silver |

Both programs are run by TIAA-CREF Tuition Financing under state oversight, so day-to-day user experience feels similar. The big differences: Illinois offers a richer state tax break and a wider fund menu, while Michigan relies on ultra-low costs that keep more growth compounding.

Keep those themes in mind when we compare taxes, investments, and fees next. They drive the dollars-and-sense trade-offs that matter most.

State tax benefits and gotchas

Contribution deductions: your instant rebate.

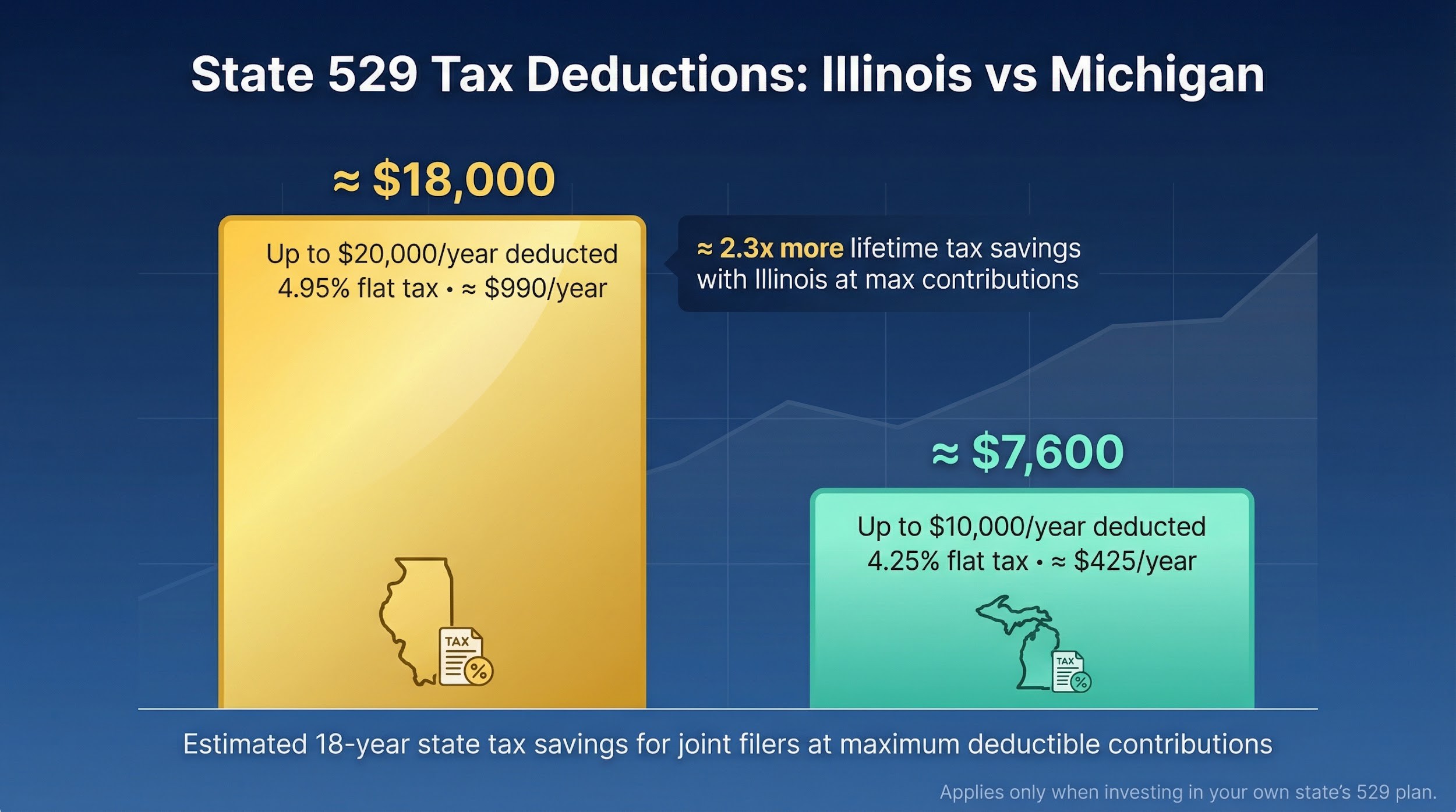

State income-tax deductions offer the first lift. Contribute to Bright Start and you can deduct up to $10,000 per year if you file single or $20,000 if you file jointly. At Illinois’s 4.95 percent flat rate that is about $990 back on your return.

Michigan allows $5,000 single or $10,000 joint. With its 4.25 percent flat rate, the refund tops out near $425.

Over an 18-year saving horizon, an Illinois couple claiming the full amount could save about $18,000 in state tax, while a Michigan couple pockets roughly $7,600. Each deduction applies only when you invest in your own state’s plan.

Rollovers, baby bonuses, and employer matches.

Illinois adds more perks. Roll money from another 529 into Bright Start and the incoming principal counts as a new contribution, qualifying for that year’s deduction. Michigan accepts rollovers but gives no additional write-off.

Every child born or adopted in Illinois since 2023 receives a $50 seed deposit once a Bright Start account is opened. Employers can help too: an Illinois business earns a tax credit equal to 25 percent of its match, up to five hundred dollars per employee per year, through 2029.

Michigan no longer offers a newborn bonus or employer match.

Combine these extras with the larger base deduction and Illinois sets the pace on tax generosity.

Investment options: age-based portfolios

Most parents want a set-it-and-forget-it path that turns more conservative as freshman year approaches. Both plans deliver that goal, but they travel slightly different roads.

Bright Start offers two tracks. Choose the Passive Enrollment track and every dollar rides low-cost index funds that mirror the market. Pick the Active Blend track and Bright Start adds active managers seeking extra return. The glide path (the shift from stocks to bonds) is identical, so the decision comes down to cost versus potential outperformance.

MESP keeps the choice even simpler. It provides one Enrollment Year series built almost entirely from index funds. You select the child’s expected first year of college, and the portfolio handles the rest.

Which approach works best? If you want the lowest fees and zero maintenance, Michigan’s single lane wins on simplicity. If you prefer the option to tap professional stock pickers, accepting a modestly higher expense ratio, Illinois gives you that flexibility. Either way, automation frees you to focus on contribution amounts rather than fund details.

Next we will zoom out to the static portfolios and single-fund menus for families who like to steer the wheel themselves.

DIY portfolios: static mixes and build-your-own funds

Not every saver wants autopilot. If you prefer to manage risk yourself, both plans allow custom control, though Illinois supplies more tools.

Bright Start offers several Static Allocation portfolios (100 percent Equity, Balanced, Conservative) and, like its age-based series, each comes in passive or active form. For deeper control, Illinois lists roughly 20 single funds spanning U.S. and international stocks, bonds, real estate, and an FDIC-insured savings option. You can build a tailored mix or tilt toward a favorite asset class.

MESP is leaner. It provides six static multi-fund portfolios from aggressive growth to principal protection, plus about five single-fund indexes for investors who want a focused position. The shorter menu keeps expenses low and removes weak choices.

The trade-off is clear: Illinois offers more levers for investors who enjoy fine-tuning, while Michigan appeals to parents who want quick, low-maintenance decisions.

Next we will compare what each plan charges, because costs shape long-term results.

Fees and Expenses: What Each Dollar Really Costs

Low fees are a shared promise, but the price tags differ once you do the math.

For most MESP portfolios the all-in expense runs 0.06–0.13 percent. Invest ten thousand dollars and the plan takes no more than thirteen dollars a year—cheaper than many index funds outside the 529 world.

Bright Start’s index tracks begin just as lean at 0.06 percent, but costs rise if you pick active management. An Active Blend static portfolio lands near 0.50–0.75 percent, lifting the annual cost on a ten-thousand-dollar balance to fifty or seventy-five dollars. Illinois lets you decide whether that trade-up is worth it.

Program fees echo this split. Michigan adds about 0.045 percent to every portfolio, roughly half the Illinois program fee on comparable index options. Because Bright Start partners with Vanguard and other low-cost providers, its passive choices remain competitive; the gap widens only when active funds enter the mix.

Neither plan charges enrollment or monthly maintenance fees. Minimums stay friendly: Michigan needs twenty-five dollars (or fifteen through payroll), while Illinois removed its minimum entirely, so any spare cash gets you started.

Put the numbers beside each other and Michigan wins on pure cost. Illinois offers a “choose-your-own” model: stay passive to match Michigan penny for penny or pay up for potential outperformance. Over eighteen years even a quarter-point difference can erase thousands of dollars—enough to cover books, meals, or a study-abroad term.

Performance and oversight: grades that matter

Past returns change with every market swing, so independent scorecards offer a steadier gauge of quality. Morningstar releases its 529 ratings each fall, and both plans rank near the top.

Bright Start holds a Gold rating, one of only five direct-sold plans to reach that level. Morningstar cites “rigorous oversight” by the Illinois Treasurer and “thoughtfully constructed” portfolios that have outpaced peers since the 2017 overhaul.

MESP earns Silver in Morningstar’s 2024 report. Analysts applaud its “ultra-low costs and sensible index approach,” noting consistent top-quartile returns after fees.

Watchdog site Savingforcollege confirms the strong record. Both plans carry 4-plus-star performance scores across one-, three-, and five-year periods.

The conclusion is clear: neither plan raises performance concerns. Index options in both should deliver comparable market gains; the deciding factor is cost. Michigan keeps more growth in your account through lower fees, while Illinois’s active funds must clear a higher hurdle to come out ahead.

Day-to-day ease: managing, moving, and spending your 529

Opening either account is quick. You enter basic details, link a bank, and you are set. Bright Start has no minimum, so even ten dollars starts the clock. MESP requires twenty-five dollars, or fifteen through payroll deduction.

Both plans run on TIAA’s platform, so the online dashboards feel familiar. You can schedule automatic drafts, adjust allocations, and download year-end tax forms without digging through menus. Gift contributions land easily through Ugift codes, avoiding paper checks.

Bright Start 529 Online Dashboard and Account Management Screenshot.

Customer support is similar. A toll-free line reaches college-savings specialists, and email replies arrive within a business day. Illinois also offers optional Zoom sessions with a Bright Start consultant for hands-on guidance.

Portability is straightforward. Federal rules allow one rollover per year to another state’s 529. Keep in mind that Illinois or Michigan will recapture prior deductions if you move dollars out before using them for college.

Spending funds is simple. Submit tuition bills online or request a direct payment to the school. Qualified expenses include room, board, books, and required technology at any accredited U.S. college and many overseas programs.

Day-to-day, both plans feel tap-and-go. The meaningful differences remain tax perks and fees, not user experience.

Which plan fits you best

If you live in Illinois, Bright Start is the front-runner. A contribution of up to $20,000 for joint filers trims state taxable income, worth about $990 a year, and you qualify for the newborn deposit and potential employer matches. Stay in the passive index track and your costs match Michigan’s, so there is little reason to look elsewhere.

Michigan residents benefit from MESP. The state deduction tops out at $10,000 joint, yet the plan’s low expenses keep more growth compounding. Unless you need active-management options, continuing with MESP is the practical move.

For residents of other states the decision depends on priorities. If you want broad fund flexibility, including active strategies, Bright Start provides it for a modest fee increase when you select index portfolios. If you prefer a simpler, always-cheap route, MESP delivers.

Relocating? Leave existing balances in the original state plan to avoid tax recapture, and direct new contributions to your new home plan to secure its deduction. This split approach often beats rolling every dollar and repaying past tax breaks.

Bottom line: both programs rank among the best. Choose the plan that matches your tax address, fee comfort, and desired level of control, then automate contributions and let compounding do the work.